Intro

Intro

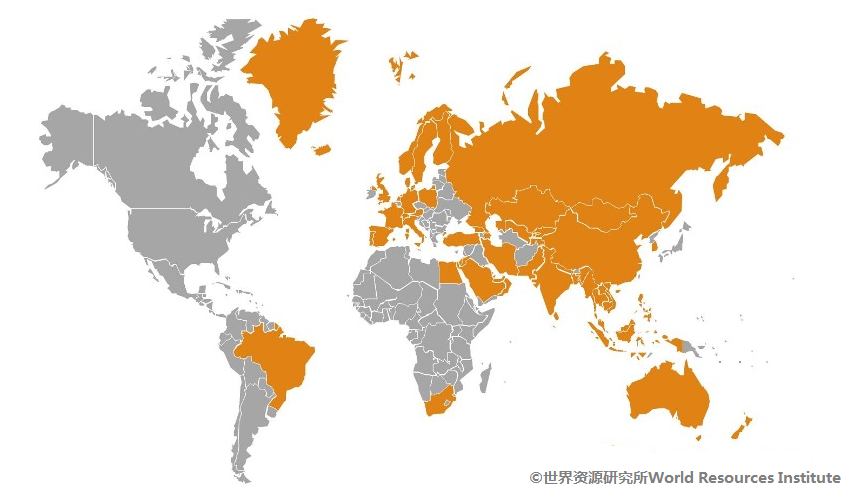

By this mid-April, the founding member application to join Asian Infrastructure Investment Bank (AIIB) has temporarily come to an end, a total of 57 countries covering five continents have applied, of those 37 are Asian countries, four of permanent UN Security Council members, and over half of the G20 member countries. The bank will continue to accept new members, but only as ordinary member countries. The AIIB will mainly invest in infrastructure construction, which not only helps to narrow the gap of financial need for infrastructure construction in developing countries, but also accounts for the infrastructure improvement in other areas. The AIIB charter will be signed before the end of June, 2015. The bank will feature a three-level management structure that includes a board of governors, board of directors and senior management with effective supervision mechanism to guarantee efficiency and transparency. Also, AIIB has showed their positive attitude towards learning and adopting global experience. Various stakeholders have expressed their expectations: multilateral development institutions like World Bank have expressed willingness to support and cooperate with AIIB; international financial experts suggest that the governance structure, operational standards, investment and financing mechanism are essential for successful operation; meanwhile, environmental and social safeguard policies have become the concern of environmental think tanks and civil societies. In this issue we present the update of the AIIB and different suggestions and views towards AIIB.

Alert

Alert

- AIIB founders finalized at 57 nations, will establish an efficient organization with clean governance and zero tolerance on corruption

- World Bank ready to share experience with China-proposed AIIB

- Beijing's new development bank divides western nations

- China approves reforms to three policy banks, The CDB positions as development financial institution

Resources

Resources

- Report: The World Bank Inspection Panel , Accountability Counsel

- Report: The Asian Development Bank , Accountability Counsel

- Report: Striking the Balance: Ownership and Accountability in Social and Environmental Safeguards , WRI

View

View

- Switzerland does not consider the China-led Asian Infrastructure Investment Bank (AIIB) as a rival to other multilateral development banks, such as the World Bank or the Asian Development Bank. In financing urgently needed infrastructure in the region, the AIIB can contribute to a sustainable economic development and to the alleviation of poverty. We hoped that the AIIB will become a strong, effective and efficient Multilateral Financial Institution, complying with international best practices and international standards, and make a strong contribution to fill the infrastructure gap in the region ——Beatrice Maser, Head of Economic Cooperation and Development.

- Now comes the hard part for AIIB: creating a development institution that is responsive to both the diverse needs of its Asian borrowers and the governance concerns of its broader funding countries in Europe and elsewhere. AIIB can use this unique opportunity to establish the “right standards” rather than to simply duplicate the supposedly “highest standards” of existing institutions such as the World Bank, the IMF and the Asian Development Bank. The “right standards” include three key elements: First, like all major companies and banks, the AIIB board should convene only periodically to review policies and provide guidance. As to avoid staff and management spend far too much time preparing numerous lengthy reports for board approval or information, therefore lack of focus and project preparation is excessively costly. Second, with its aim of a more specialised focus on infrastructure and less involvement in direct poverty-related activities such as education and health and possible reliance on the other agencies for macroeconomic reporting, the AIIB could avoid the need for large field operations. It could instead consider placing a few core staff in existing World Bank or Asian Development Bank field offices — providing efficiency gains as well as combined experience. Finally, the concerns on safeguards to avoid or mitigate any negative social and environmental consequences of projects merit the attention they are receiving. The aim should be not to lower standards but to develop more sensible ones. Yukon Huang Senior Associate of Carnegie Asia Program and former World Bank Director for operations in Asia and Europe

Please send us your comment to FDI@ghub.org

We welcome your feedback and will share some selected insight upon permission in next issue.