Overview Between July 12-13th, Luxembourg played host to the AIIB 4th Annual Meeting. The theme of the 2019 Annual Meeting was "Cooperation and Connectivity", in recognition of the economic and social benefits to be realized through better connectivity within and between countries and regions, including Europe and Asia. The 2019 Annual Meeting brought together participants including AIIB's members, prospective members, partner institutions, business leaders, civil society and experts from a range of fields. AllB and the aforementioned participants discussed multilateral cooperation, digital connectivity, meeting the commitments of the Paris Agreement, blended finance and sustainable infrastructure. These topics were discussed in order to better understand how cooperation and strategic investments in sustainable infrastructure can contribute to deeper integration and stronger economic growth via enhanced connectivity. During the annual meeting, AIIB approved three African countries membership applications; namely, Benin, Djibouti and Rwanda, taking the total membership of the AIIB to 100. In total, four projects were approved. These include Municipal Water Supply and Sanitation Project (Bangladesh) and Fiber Optic Communication Network (Cambodia) in addition to two projects with financial intermediaries (FI, hereafter), the L&T Green Infrastructure On-Lending Facility and the Asia Investment Fund.  Opening Ceremony of the annual meeting (Source: www.aiib.org) Facts about AIIB Launched shortly after the Paris Agreement was adopted at the Paris Climate Change Conference in 2015, AIIB has made progress in the construction of its own governance as well as project development and implementation. So far, AIIB has released Environmental and Social Framework (ESF), Energy Sector Strategy: Sustainable Energy for Asia, Policy on Public Information (PPI) and Policy on the Project-affected People's Mechanism (PPM). In 2018, AIIB released Transport Sector Strategy and Sustainable Cities Strategy. Regarding project implementation, AIIB has approved 46 investment projects, totaling 8.53 billion USD, with another 23 projects in its pipeline. According to BIC Europe①, until the 11th of July, projects centred around water, transportation, and urban construction account for 50% of AIIB's total portfolio, energy projects constitute 35%, while 15% has gone to funding through FIs. According to the list of approved projects disclosed by the AIIB, natural gas and hydropower projects still account for the majority of the bank's current energy investment, followed by energy efficiency and other energy projects such as power transmission and distribution. The Egypt Round II Solar PV Feed-in Tariffs Program co-financed with the IFC is currently the only renewable energy project involving wind and solar power generation. |

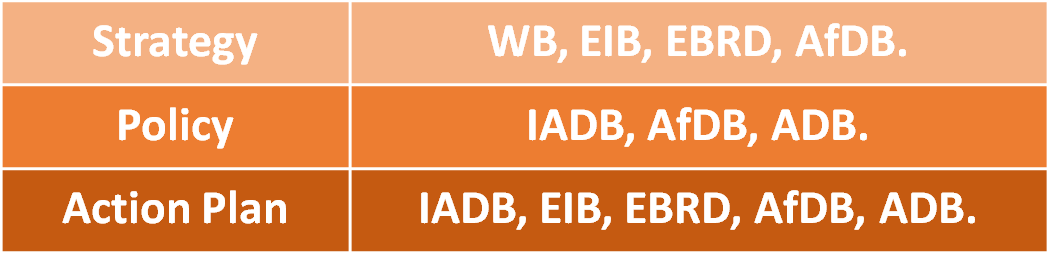

"Multilateralism" on the Front Line of Climate Action During the annual meeting, the urgency of tackling climate change and AIIB's determination to take action were mentioned on multiple occasions. During the opening ceremony, Jin Liqun stated, "Climate change mitigation is crucial for all of us and, more importantly, for generations to come. There is no alternative but to tackle this challenge head-on." Luxembourg's Minister of Finance, Pierre Gramegna, underlined in his keynote speech, that "Only multilateralism and international cooperation can insure reaching the Sustainable Development Goals by 2030 and tackle the challenge of climate change." In this context, he highlighted the emphasis that AIIB has placed on green and sustainable finance: "I am pleased that several seminars held during this year's annual meeting will focus on the commitments of the Paris agreement and the future of sustainable finance." During the two-day annual meeting, AIIB and delegations from various fields discussed how bilateral and multilateral cooperation can promote the transition to climate-friendly infrastructure in developing countries, the challenges and opportunities for blended financing in the context of climate adaptation, and the European off-shore wind power development. AIIB's commitment to take action is also reflected in its banking strategy. In 2006, AIIB issued the Energy Sector Strategy (Issue Note for Discussion), abbreviated to Strategy, in which the bankproposed its support for the Sustainable Energy for All (SE4ALL) initiative, the Paris Agreement and the 2030 Agenda for Sustainable Development. With "Reduce the carbon intensity of energy supply" as one of its guiding principles, the Strategy stressed that its energy investment needs to help countries achieve their respective NDCs. However, relevant research and analysis② show that the guiding principles of the Strategy are only partly aligned with the goals of the Paris Agreement. This is also true for the listed investment priorities, with investments in renewable energies and natural gas appearing to be considered as equally relevant in the Strategy. Additionally, oil- and coal-fired power plants are not excluded. In fact, AIIB still relies on fossil energy, accounting for 20% of the total portfolio, while renewable and other energy projects such as power transmission and distribution account for 8% and 7% respectively. Furthermore, hydropower projects that are controversial due to their environmental and social risks account for the majority of the approved renewable energy projects. AIIB management responded to questions about specific projects and more generally implementing climate commitments at an event held for stakeholders and the executives of the bank, in which three presidents were present. During the discussion, AIIB expressed its desire to help developing countries and regions to reduce carbon emissions and achieve climate goals but not to the detriment of meeting the basic energy needs of its member countries. From both strategic and implementation dimensions, President Jin Liqun and Vice President of Policy and Strategy Joachim von Amsberg, responded respectively on the issues of coal, natural gas, hydropower, energy efficiency, power transmission and distribution, as well as decentralized energy such as wind and solar power. The following is a transcript compiled by GHub's on-site observer based on the three presidents' responses: - On overall energy investment under the climate commitment: "Many of our member countries have increasing demand for power. I'd like to ask your advice on how can we respond to this request or need [...] When we say green, we want to do it in an integrated manner. Only doing green projects is not enough, we also look at efficiency of the power" "Our job is to help low income countries to move from high-carbon economy to low-carbon economy, eventually to zero carbon. It is a very important transition thatmany countries are struggling with. But how can we help them to go down to zero is a challenge. I think we need to work together, in a realistic manner." "We are a bank that opened its doors a month after Paris (Agreement), it's not by coincidence [...] We have worked with the other MDBs to adopt a common framework for the Paris alignment, on assessing projects, classifying their climate impact. We have committed to actions such as including carbon shadow pricing in our project evaluation. So we can make sure that our projects really make sense from a de-carbonization perspective [...] We want to not only help countries with the implementation of their NDCs, but we do recognize that the target of 2 to 1.5 degrees actually goes beyond what is currently committed, this should be kept in mind while financing projects." "We want to accelerate the transition, we know that many of you (CSOs) are concerned about climate change, so we want to be each other's partners. You can help by mobilizing support, bringing information in project level. We can help by prioritizing renewable and energy efficiency projects." - On coal, gas and other fossil fuels: "The reality is that we have not financed any coal power generation, we have no coal-fired power generation in our pipeline. I think the discussion has moved on, in many situations coal is no longer competitive, and that is good." "Regarding the strategy (Energy Sector Strategy), the intention is to not to finance coal. The intention is how can we help some of these countries who need power, and have no money for (gas)." "Some new technology, such as Ultra Super-critical Coal Power Plants, were proven that their emission is almost the same as gas. Still, coal is coal." "We are agreed with our members during discussions of the energy strategy, many countries' low-carbon transition strategy actually includes natural gas,so we are financing natural gas. I know that not everybody likes it, but after advice from experts and discussion among our members, that was an agreement, recognizing the need for universal energy access." - On hydro: "We are extremely careful about hydropower considering it has challenges that we have to deal with, such as resettlement, biodiversity of helpless species." "The projects we have financed have made very sensible measures to upgrade the generation capacity from existing reservoirs. For example, Nurek in Tajikistan (Hydropower Rehabilitation Project, Phase I) and Tarbela in Pakistan (Tarbela 5 Hydropower Extension Project). These investments are meant to increase the energy output from an existing reservoir. These kind of projects have much less risk than making new reservoirs [...] We have financed 45 projects so far, very few of them are hydro and the same applies to our pipeline. Our program is quite modest and I can assure you we will look extremely carefully at every project proposal that's taken forward." - On distributed renewable energy: "While energy projects like solar panel and wind cannot supply the power to reach the needs, what can we do? We are improving the power transmission system, to cut the systemic loss down to the level of developed countries. So without building new power plants, we can meet the increasing power needs." "We want to be the bank of the future. And I think the bank of the future will finance renewables and energy efficiency. And that's where we want to be and you can help us be there." Generally, AIIB's commitments on tackling climate change at the annual meeting is commendable. Although not reflected in the policies, the management of the bank expressed their rejection of coal-fired power generation. However, AIIB maintains an open attitude towards oil and gas. Earlier this year, GHub and five environmental think tanks jointly researched and published reports on alignment of AIIB's environmental and social related strategies and policies, as well as the project implementation to the Paris Agreement and the SDGs. Based on good practices of other multilateral and bilateral mechanisms, the following recommendation show the AIIB can better align with the goals of the Paris Agreement are partly compiled from the report: - AIIB should formulate a detailed climate action plan in accordance with the 2050 long-term development strategy for greenhouse gas emissions submitted by countries in advance of 2020 under the Paris Agreement; - low-carbon infrastructure investments according to NDCs, long-term low-carbon development strategy, and SDGs should be prioritised; - projects including coal- and oil- fired power plant as well as related infrastructure should be excluded from the policy; - regarding the project review, AIIB should apply innovative evaluation approach and mechanisms, in order to encourage member states to develop small- or medium-scaled, distributed, climate-resilient infrastructure projects, and provide policy guidance and mobilize capital to renewable energy and low carbon development related fields. The First Review of the ESF At the annual meeting, stakeholders raised questions regarding the implementation of the ESF and procedures and timeline for its first review*③. The environmental and social safeguard is a policy tool for MDBs to manage the environmental and social impacts of their operations, investments and financing activities, which is essential to ensure the sustainability of the bank's development. After public consultations, AIIB's ESF was officially released in January 2016. According to the regulations, the review of the ESF should be carried out every three years, which means that the first review should be conducted this year. The reason why the first review has garnered much attention is not only due to the fact that the existing ESF does not fulfill some demands regarding sustainable development, but also because of problems exposed during the implementation of the ESF. These include a lack of effective consultation and information disclosure with project-affected people, environmental and social impact assessments not being fully conducted, and the inconsistency of assessment documents and the provisions in ESF. In addition, when AIIB undertakes co-finance projects with other financial institutions or cooperates with financial intermediaries, the issue of how to ensure the effectiveness of the implementation of ESF and how to divide responsibility boundaries needs to be further clarified. In the first two years of operation, AIIB mainly developed projects through co-financing with other multilateral development banks. In these cases, the environmental and social safeguards and accountability mechanisms of the project usually rely on the co-financing institutions. In recent years, the number of AIIB's stand-alone projects has gradually increased. According to statistics from AIIB itself, until January 2019, the percentage of stand-alone projects of the bank has reached 40%. During this period, various problems arising from the implementation of ESF have gradually emerged. In the following, we take the Bangladesh Bhola IPP project as an example. According to a survey④ led by a local NGO, the power plant raised issues regarding the threats to bio-diversity in the region, a lack of public participation, insufficient information disclosure, involuntary land acquisition, damage to livelihoods of residents who rely on fishing and cattle-grazing, compensation not being in place, and the violation of national laws and regulations. Moreover, environmental and social impacts of the project construction such as noise pollution, floods, possible diesel leakage and damage to habitats of endangered species are not reflected in the corresponding environmental and social risk management documents. Simultaneously, AIIB is gradually opening up a window of cooperation with FIs. Until July this year, its FI projects constituted 15% of the total portfoplio⑤. As an example, reports indicate that the National Investment and Infrastructure Fund for India invested by AIIB has problems with project investment delays and information opacity⑥. According to past experience and lessons, the investments and financing projects indirectly implemented by MDBs through FIs often cause environmental and social problems due to the negligence or lack of capacity of their clients, which will eventually incur economic and reputational losses to the banks themselves. The issues mentioned above reflect the ineffectiveness of ESF in supporting and safeguarding the sound implementation of environmental and social risk management by AIIB and its clients. Although AIIB has expressed a willingness to improve the issues mentioned above, they still apply a case-by-case approach to the implementation issues of the project, without linking to the necessary improvementsto the ESF. Instead of investigating the negative impacts of every individual project, it is more important to strengthen the supervision of safeguard policies, in order to prevent and manage risks during project review and design. As Vinod Thomas, Director-General of the Independent Evaluation of ADB, said: "The commitments for safeguard provisions are critical, because the onerous cost of safeguard provisions is actually lower than bearing the consequences […] Established banks and newcomers alike have reached a growing consensus on the question of what is a desirable scope of safeguards, however the issue of how to get good compliance remains highly problematic." In addition to this, scholars from the University of Oxford⑦ believe that international standards have the potential to catalyse more investment by mitigating risks that may lead to project failure, especially projects that often fail due to mismanagement of environment and social risks, including labor standards, land acquisition, pollution, bio-diversity, etc. Based on this, we suggest that in order to ensure the environmental and social performance of the projects and keep the clients accountable, eventually to avoid reputation and economic losses, AIIB should look into both the policy and operation of projects, and grasp the opportunity of the review of the ESF to conduct an independent, evidence-based review of the performance of the ESF by learning from other development financial institutions. We also recommend that AIIB disclose detailed timetables to receive oversight and feedback on the ESF from the public and stakeholders. Gender Equality Brought to the Table On the eve of the annual meeting, AIIB expressed through social media that both women and men should be consulted on their respective needs when infrastructure projects are undertaken and that challenges in designing infrastructure so that it is beneficial and accessible to all stakeholders would be spotlighted during the annual meeting. At a seminar of the annual meeting, Michaela Bergman, the Principal Social Development Specialist of AIIB, and experts from MDBs, engineering industry, government departments and other gender and infrastructure related fields discussed the issue of how to measure the gender gaps in access to infrastructure, as well as how infrastructure can be designed, constructed and operated to benefit both women and men. During the annual meeting, AIIB emphasized that the design and operation of infrastructure projects should respect all genders. In the dialogue between the bank's management and civil society, the presidents of the bank have mentioned multiple times the importance AIIB places on gender equality, especially regarding raising awareness and capacity building among AIIB's employees, as well as the importance of accessibility of infrastructure projects for women. An Indian NGO which focuses on gender equality raised concerns about gender sensitivity issues after tracking the Gujarat Rural Roads (MMGSY) Project (India), which was invested by AIIB in 2017. In fact, AIIB pointed out in the project document⑧ that the project aims to substantially improve connectivity and mobility in the project areas and bring huge socioeconomic benefits to the rural residents, especially the women and children among the poor. However, a field survey⑨ finds that problems remain in actually fulfilling the gender-related criterion, such as the issues of unequal gender representation among project employees, the lack of facilities to protect women's safety, and the violation of workers' rights and interests. On socially sensitive subjects, AIIB is suggested to make progress in specific issues on a case-by-case basis and to issue a comprehensive gender policy. This policy should include gender-related indicators in employee performance evaluation incentives, risk assessment and safeguards to end gender discrimination issues such as unpaid domestic labor, sexual- and gender-based violence, and patriarchal land ownership. Throughout the world, sustainable infrastructure is central to economic development. Giving access to women and girls to education, health care, decent work and participation in political and economic decision-making is essential for countries to achieve inclusive and high-quality sustainable development, which is also reflected in the UN 2030 SDGs. Throughout the history of development finance, gender perspectives have been increasingly influential in the decision-making of project financing. Defending women's rights and interests has become an important social factor that must be considered in financial operations. Traditional multilateral financial institutions have introduced corresponding strategies, policies, and action plans⑩ (see table below). While further work is required, the existing practice can serve as a reference for AIIB to improve gender-sensitive risk management in the future.  Table: MDBs with existing gender-related strategy, policy, and action plan To Be Continued In the "Post-Paris era", global development is facing challenges including tackling climate change, eradicating poverty, promoting gender equality and protecting bio-diversity. As a MDB born in the aftermath of the Paris Agreement, AIIB's work is destined to be intertwined with the bigger picture. As AIIB has become increasingly influential on regional and global infrastructure construction, it has garnered more and more attention. As such, the international community has great expectations for AIIB to contribute to the progress of global development. With those expectations, we hope that AIIB can continue to maintain communications and cooperations with various stakeholders, and to be more open and inclusive to the participation and supervision of civil society with missions of promoting sustainable development. This is regarded as crucial for AIIB to develop innovative financing mechanisms and establish a good operating model in the years to come. Looking ahead, the 5th AIIB Annual Meeting will be held in Beijing. When it returns to its place of birth, it remains to be seen if AIIB can implement its core values of being "Green, Lean, and Clean", especially "Green", more inclusively, actively and thoroughly. *"Review of the ESF. Based on the experience gained from the application of the ESP and ESSs to individual projects during the first three years of the Bank's operation, the Bank will, at the end of this period, conduct a review of the overall Environmental and Social Framework. As warranted, updates would be introduced to the framework, and further improvements to the ESP and ESSs would be recommended to the Board of Directors for approval. Emphasis will be placed on dynamic learning from both design and implementation of Projects in the diverse countries served by the Bank." (AIIB, 2016) Read More G:HUB Observation | AIIB Third Annual Meeting G:HUB Observation | AIIB Second Annual Meeting & Policy Updates Comments on the Draft Policy on Public Information of AIIB Filling Sustainable Infrastructure Gap in Asia: AIIB as a Catalyst and Orchestrator Aligning AIIB with The Paris Agreement and the SDGs: Challenges and Opportunities Reference 1. BIC Europe and The Big Shift Global (2019). AIIB and Climate Change. 2. Hirsch, T., Bartosch, S., Yao, A., Hongyu, G., Menshova, Y., Padhi, A.T. and Shamsuddoha, M. (2019). Aligning the Asian Infrastructure Investment Bank (AIIB) with the Paris Agreement and the SDGs: Challenges and Opportunities. 3. Asian Infrastructure Investment Bank. (2016). Environmental and Social Framework. [pdf] pp.2. Available at https://www.aiib.org/en/policies-strategies/framework-agreements/environmental-social-framework.html [Accessed 2 August. 2019]. 4. Hasan, M., Md. Sajjad, T. and Mahbub, A. (2018). Bhola Integrated Power Plant (Bhola IPP) and its Impact on Local Communities: Voices from the Ground: A Civil Society Study Report. 5. BIC Europe and The Big Shift Global (2019). AIIB and Climate Change. 6. Geary, K. and Munshi, A. (2019). Financing the future? The Asian Infrastructure Investment Bank and India’s National Investment and Infrastructure Fund. 7. Ha, S., Hale, T., and Wang, X. (2019). Filling the sustainable infrastructure gap in Asia: AIIB as a catalyst and orchestrator. 8. AIIB (2017). Project Document of the Asian Infrastructure Investment Bank: Republic of India Gujarat Rural Roads (MMGSY) Project. 9. Bercher, T., Wertman, H. and Zuckerman, E. (2019). Roadblocks: Unmet Gender Promises in AIIB’s Gujarat Rural Roads Project. 10. Bercher, T., Wertman, H. and Zuckerman, E. (2019). Gender Policy Tips for Newer IFIs Lessons from Traditional IFIs Gender Policies – a Factsheet and Table. |